Startup Businesses

Startup Businesses

There are broadly two types of startup businesses in the world.

I believe, as a founder, it is very important to know which bucket you fall into. It impacts how you raise funds, your decision-making processes, as well as your hiring and technology strategy.

Multiple Businesses

Most of the startups in the world fall into this bucket. In this scenario, the startup focuses on a short-term problem statement and tries to monetize it. The valuation of startups that fall into this category is pretty simple: it is a multiple of the revenue based on the industry they fall into.

Characteristics

Product-Market Fit at Inception or Within Years 1 or 2

The core value is driven by a short-term market opportunity like regulation change, geopolitical situation, industry transition, consumer behavior change, etc.

The product might be faster and cheaper than the alternative on the market.

Upside

- Investing in multiple businesses is pretty straightforward. There is no guessing game. It is fairly trivial to model the business as TAM, SAM, and SOM are applicable.

Downside

There is a chance that the organization's growth and revenue might plateau.

Multiple businesses might lack a long-term vision.

The window of opportunity is very short.

Opinion

For businesses like these, when the PMF is reached, you want to be cautious about hiring too much, as it might lead to a huge burn that might not be recoverable in the future. If you are in this bucket, focusing on unit economics, profitability is what is being rewarded in these market conditions.

Long shot Businesses

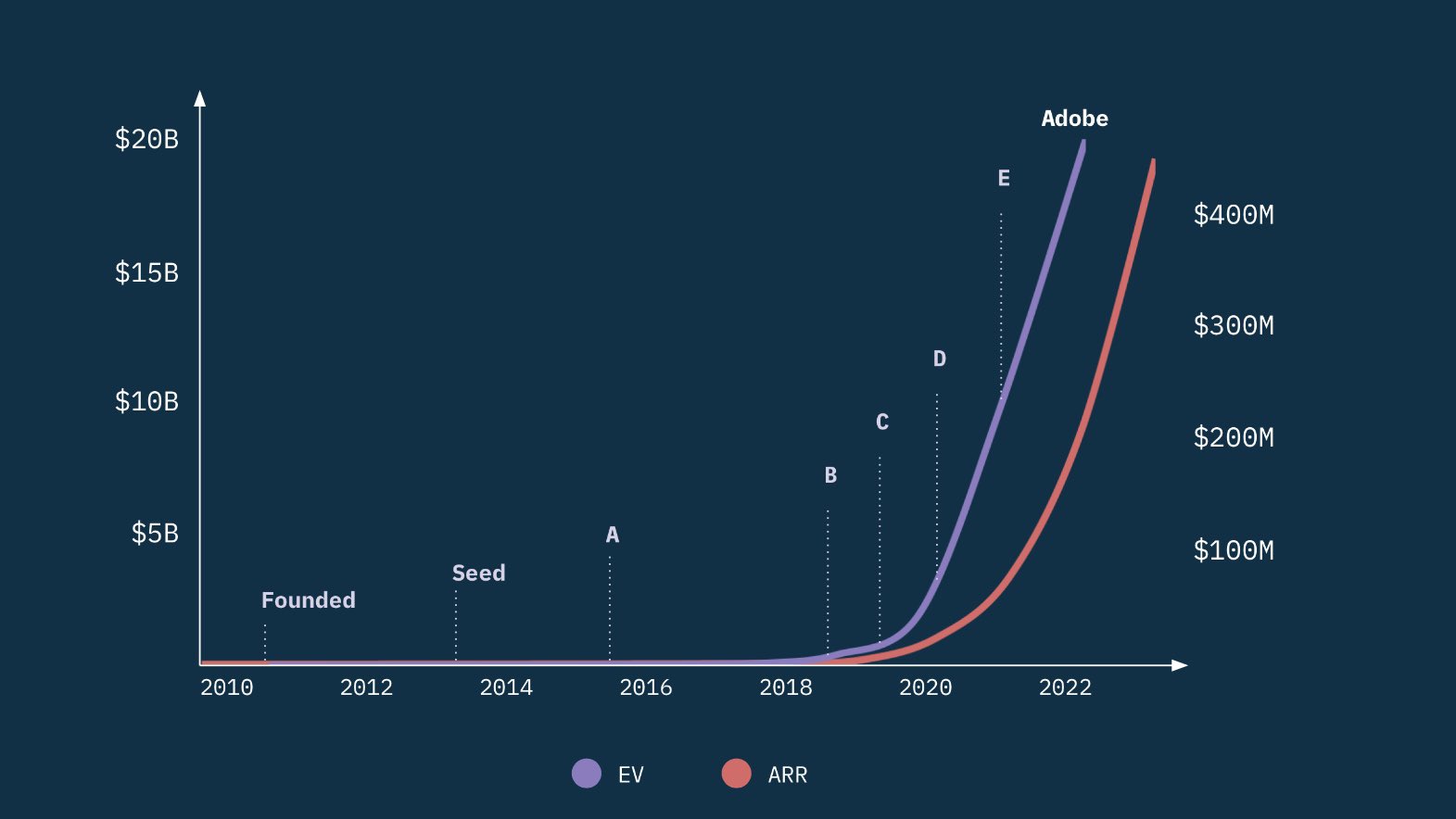

This is generally difficult to identify. An example of an organization that falls into this category would be Figma. For instance, for a very long time, the organization did not make revenue. But the organization was determined and mission-driven towards making a browser-based design tool.

There are multiple examples of long-shot businesses in healthcare, frontier technologies, etc. In recent times, AI-driven businesses have created this opportunity.

Characteristics

There is no clarity on the product market fit for a very long time.

Driven by a mission

Resilience in the founding team

The inflection point for the startup comes way ahead in the future.

Upside

The startup is on the path of pure innovation. Typically driven by first principles.

If the startup hits the infliction point, the growth is like a steep hockey stick.

Downside

It is very difficult to identify and model a startup like this.

Business, revenue, and growth models are often not very clear.

Needs a huge amount of investment to reach the infliction point. If not investment, then resilience in founders is required. As a founder in this category, if you get investors excited about the possibilities of the technology, you can raise it at a crazy valuation.

Opinion

Many founders, when they start out, believe they are pioneers in technology. They build the organization in that fashion. Focusing too much on the long term might impact the short-term prospects of the organization. The reality is that only a handful of them are truly groundbreaking.

Conclusion

In 2021, every startup will be treated and valued like a long-short business. Given the macro-conditions, these valuations are catching up. However, in 2023, we are seeing AI startups in the long-shot category. The problem is that in this space, there are few businesses that fall into the first category and are valued as long-term businesses. We have to wait and watch how things turn out in this space.